There are many famous quotes passed down over the years by hundreds of investment gurus and while I think that reprinting witticisms conjured up by self-anointed messiahs is disingenuous at best, I use them as a token of respect for the author. I love to quote Richard Russell because he was easily the finest storyteller of all newsletter writers since they started handing out "cheat sheets" on the New York "curb" in the last 1800's. He was also the person who gave me the idea for a newsletter.

Richard Russell studied the works of Charles H. Dow, who published a series of essays on stock price movements in the 1800s, and later on, the works of Robert Rhea, who carried on with Dow's theories. The term "Dow Theory" refers to the complete body of work of the man who founded the Wall Street Journal and who invented the averages that bear his name. His work lives on today, with many (including yours truly) that use his methods of analysis to manage risk in the U.S. markets. In fact, one of his most important determinants in timing the market was the use of "confirmations," where one average hits either a new high or new low for a particular move but is not joined by other related sub-indices.

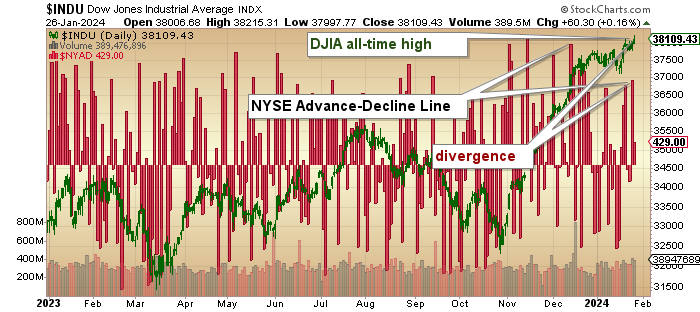

There are a number of non-confirmations, otherwise known as "divergences," that are popping up everywhere this week. The first one is a "Dow Theory non-confirmation" of the new all-time high in the Dow Jones Industrial Average that was not confirmed by the Dow Jones Transportation Average.

The second divergence was the failure of the NYSE advance-decline line to register a new high that would have confirmed that market breadth was mirroring the strength in the blue-chips.

Instead, it appears as though the troops are in retreat while the generals are charging the enemy forces, which is never a recipe for victory on any continent.

Alas, while there are many other warning signs, such as a report late last week that suggested that most of the buying in the "Magnificent Seven" (Microsoft, Apple, Amazon, Alphabet (Google), Meta (Facebook), Nvidia, and Tesla) is coming from retail finger-traders while the prop desks and the hedge funds are shorting everything in sight.

Since it is still the "MAG 7" driving the averages higher, I am amazed at the power of the retail investor base in controlling prices, but if there is one thing I have learned over the years, it is that the big boys still have a vice-grip on anything that makes money on Wall Street and if the prop desks are shorting stuff now, this advance that began nearly three months ago is on borrowed time.

Nevertheless, all the crystal ball prognosticating in the world cannot stop me from being plagued by the notion that the Biden administration is feeding liquidity to the banks in order to keep equities elevated until after the November elections. I try my best to avoid the cynicism that pervades my entire thought process when it comes to markets that are deemed important to the banco-politico cartel that controls everything from LIBOR to Fed Funds to London gold and Argentine silver, but I simply cannot. Too many scars to imagine. . .

For this reason, I am carrying a modest short position on the Dow Jones Industrial Average's ETF (DIA:US), whereas at other times, I would be carrying a massive short position because all of the signposts that have aided me in calling past reversals are now in screaming "SELL" mode.

All, however, except one — this is an election year, and I do not believe for a New York minute that these markets are being driven by "free market capitalism."

Lithium

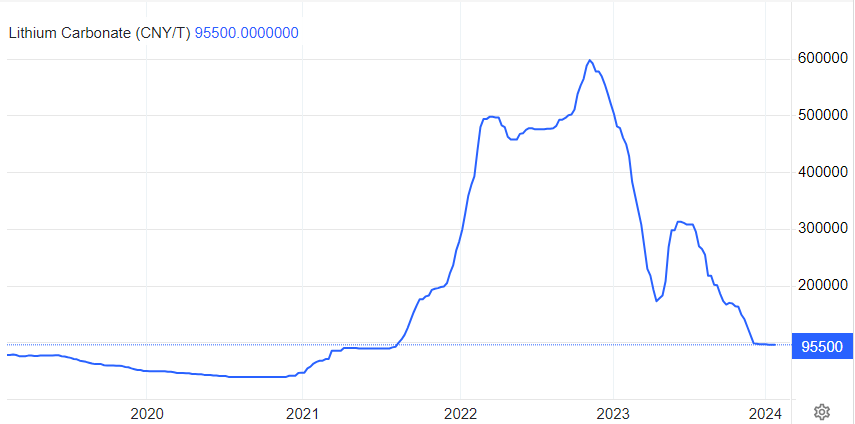

One year ago, the Twitterverse and YouTubia were sporting legion after legion of lithium bulls as the price of lithium had advanced from 35,000 CNY/tonne to over 600,000 CNY/tonne with industry leader Albemarle Corp. (ALB:US) clipping along at a hefty $285/share after peaking the prior quarter over $320.

The TSXV was inundated with gold and silver producers filing name changes from the likes of "Foo-Foo Gold" to "Lulu Lithium" by the hundreds as they moved to stake any piece of moose pasture within 1,000 kilometers of a lithium occurrence.

Today, they have all crashed. ALB closed out the week at $119.84, with TSXV high flyer Patriot Battery Metals Corp. (PMET:TSXV) touching CA$6.15, down from the 2023 high of CA$17.74. However, what I cannot forget is the chorus of lithium bulls spewing out podcast after tweet after email blast lauding the wonderment of the lithium-ion battery and how Chinese demand was going to force them to buy billion-dollar ore bodies in the wilds of northern Quebec in order to satisfy EV production requirements.

Alas, that old horse chestnut came bubbling to the surface once again, proving in painful finality that "the best cure for high prices is high prices" because the experts that were screaming "million dollars per tonne lithium!" are now calling for a glut in battery metals until 2028. Bagholders of the world unite!

Uranium

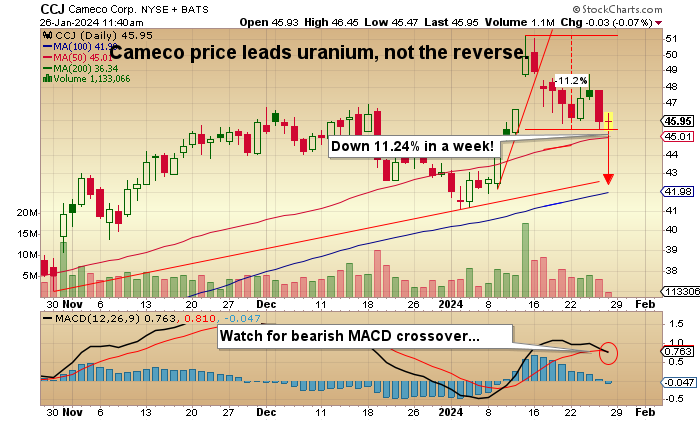

So, with the lithium story as the precursor, I am now going to post four charts on the current darlings of the latest electrification mania — uranium. Here are a number of charts for Canadian uranium deals. Note the MACD indicators for Cameco Corp. (CCO:TSX; CCJ:NYSE), Denison Mines Corp. (DML:TSX; DNN:NYSE.MKT), NexGen Energy Ltd. (NXE:TSX; NXE:NYSE.MKT), and Western Uranium & Vanadium Corp. (WUC:CSE; WSTRF:OTCQX).

Now, make no mistake. I have been a uranium bull for years, having endured several false starts since 2018 until it finally caught a serious tailwind in 2020. With 58 nuclear reactors currently under construction across the globe, with 22 of them in China, and with Cameco and Kazatomprom (KAP:LSE) having production issues, I cannot imagine a more bullish narrative for any commodity during my entire 45-year career.

So, I ask a really dumb question. "Why are these uranium darlings rolling over?"

Cameco and Denison are about to register MACD "sell signals," while NexGen and Western U&V have already flipped to bearish. While there could be a final spike based on the spot price for uranium, the share prices are telling me that lower prices are on the horizon. I issued a "sell" on Western U&V above $2.25 last week, hoping that all of my subscribers/shareholders could take profits, and that came after I took profits on the Cameco calls with the March $40 calls going out at a 3-month double.

I learned from the teachings of Richard Russell over three decades ago that the language of the market, while foreign to many, always sends a message. The message that lies in the price action of these uranium superstars may be encrypted, but it is clear to an old-timer like me: since gold stocks lead gold bullion, and oil stocks lead oil prices, I have to believe that uranium shares lead uranium prices.

This will not be a popular narrative for the legions of Rick Rule admirers (of which I am one) as they (errr – "we") all recite to the absolute dotted "i" and crossed "t" how many 22-baggers Rick had during the last uranium bull market. It is agonizing beyond belief to imagine that uranium could follow the demise of lithium and suddenly be in a glut, but I seem to recall back in 2018, with cannabis darling Canopy Growth (WEED:US) trading at $687 per share how the bulls were calling it a "slam dunk" to $1,000 "once the Yanks legalize pot."

WEED went out this week at $6.13 per share, but please trust me when I tell you that the pumpers — er, investors — really meant it when they told their teenaged pro shop attendant it was a "$1,000 slam dunk" as he polished up those Ping G430 irons.

Copper

Now, on a positive note, now that I have trashed two of the three metals considered vital to the implementation of the Global Electrification Movement, there is one metal yet to rise from the ashes of the battery metals dumpster fire, and that metal is the one that actually has no need for Chinese EV sales to eliminate those 5,000,000 unsold units from that lot in outer Mongolia and that metal is copper.

Copper executed the much-heralded "Golden Cross" a week or so ago, with the 50-dma moving up and beyond the 200-dma followed by a powerful bullish MACD crossover, almost the exact opposite of the action in the four uranium stocks shown above. Money flow is positive, and the RSI had already turned higher even as copper traced out a double bottom at around $3.74/lb.

Since I used the uranium and lithium producers as evidence of a top, I now offer the shares of copper-gold U.S. giant Freeport-McMoRan Inc. (FCX:US) as evidence of a bottom and pending bull market.

(I will not add any other names of note in order to save space here, but BHP, RTZ, and a handful of other intermediate and junior copper deals all show similar technical set-ups.)

Since I always get requests for the junior, I once again point to my favorite junior exploration name in the copper space and the name is Fitzroy Minerals Inc. (FTZ:TAXV;FTZFF:US). This was formerly called Norseman Silver Inc. but management decided to rebrand the company in the copper-gold space with the new flagship property called the Caballos Copper Project located in the copper-bearing Valparaiso mining district of the Chilean Andes. Surrounded by copper majors like Cadelco and Los Andes, Caballos is a highly-prospective property with high-grade chemical targets with values of .7% Cu and .2 g/t Au (from rock chips).

Their objective is to drill off a 1,000,000-tonne resource of contained Cu averaging .5%. (That carries an in situ metal value of in excess of $8 billion). The second company in my list of "must-own" juniors is American Eagle Gold Corp. (AE:TSXV;AMEGF:US)(CA$.405 / US$.369 on the strength of the results reported recently from their NAK Property in B.C. With Teck Resources Corp. as their "significant shareholder" and with veteran minefinder Bruce Greig as their consulting geologist, NAK could easily be one of the truly great new world-class copper-gold porphyry deposits currently so sought-after by the major miners, which includes Barrick Gold Corp. (ABX:TSX; GOLD:NYSE), where CEO Mark Bristow has had no reservations about his lust for copper and he states it publicly.

The company that best compares to AE is Hercules Silver (BIG:TSXV), where Bristow recently plunked CA$23 million of Barrick working capital and comparing the drill results and market cap for both AE and BIG, AE is capped at CA$44 million versus BIG's $203 million and as I have stated before, BIG's drill results are no better than AE's which means there is a mis-pricing here and it may just be that BIG is "fairly-priced" leaving the obvious opportunity in AE.

You can see how AE has gapped higher after they reported "302 Metres of 1.09% Cu-equivalent" within a large zone of "606 Metres of .74% Cu-equivalent," and no matter how great the intercept was, these juniors always seem to come back down to fill the gaps left after such a great drill hole. Back in the day, a hole like that would result in weeks of upside probing with gaps being left behind forever, but alas, this is 2024, and with all the algobots naked shorting that goes on, you just have to hold your nose and buy them because a $44 million market cap is absurd for a deposit with as much world-class potential as NAK. If technical analysis is ever going to be pitched overboard, it will be with AE because it will not surprise me in the least if that gap down to CA$0.325 never sees the light of day ever again.

Gold (Purposely Omitting Silver)

Despite all of the gnarling and gnashing going on, gold is acting fine, and while I still see a bit more downside to maybe $1,965-1,975, I am modestly profitable on my GLD Feb $190 puts bought a few weeks ago when the GLD:US triggered a bearish MACD crossover. It is a silly trade, like stepping over a $50 bill to pick up a quarter, because there is no downside of any real size in gold.

Every time they try to hammer it down, Asian investors buy it all right back up again. Surely, there will come a point in time when gold takes on the behavior of those "Mag 7" stocks that are trading at ridiculous P/E multiples and are as overbought as Pets.com was in February 2000.

The sock puppet shown to the left was the brand mascot for the dotcom company, held out in later years as the poster child for dotcom folly as it went public in February 2000 on the NASDAQ with an $87.4 million IPO and six months later went belly-up. An $11 IPO went out at $0.19 the day it ceased operations.

Using the GLD:US as my barometer for gold, it has been finding support at the convergence of the 50-dma and 200-dma lines as it did back in mid-November. That zone shows up with USD $182.60 as the midpoint of those two lines, but since the moving averages are moving up quickly in parallel to meet the price, gold could just trade sideways until the m.a.'s catch up, which once again makes it a very silly trade to be short. I will move to cover GLD weakness next week, take my profit, and then look to get very long, some six or nine-month calls with a $220 strike price, which equates to a $2,500 spot.

As for silver, give me a two-day close above $26.50, and I will mortgage the farm, the tractor, five mules, and an outhouse to buy as much silver as humanly possible. Until then, I do not wish to hear about "rounded bottoms," "silver shortages," "intermediate cycle lows," or "magic tea leaves with pixie dust sprinkled on them." Silver acts like a well-aged humus in a Mumbai rice farm.

It has never been a popular move to publish a Sell on any stock or commodity widely held by this younger generation of traders and investors that now dominate the capital markets arena. In my day, if an analyst came out with a bearish call on a stock you begged your wife to allow you to buy with the family vacation money or college tuition funds, only to arrive home to see her sitting in your recliner with a rolling pin in one hand and the analyst report in the other, steam curling up from each nostril as her face grew redder and redder, you did not take it personally.

You did not send Instagram DMs to the analyst's wife with pictures of the local massage parlor lady from Thailand. You did not post photo-shopped pics of your analyst drop-dead drunk at Woodbine Racetrack to his bank manager. Most of all, you did not respond by trying to discredit him for his opinions, but you did attempt to win him over by challenging his assumptions or his analysis because the ultimate revenge atoning for the divorce papers delivered to you the prior day was the stock actually turned out to be a winner and it went up. That was the sweetest revenge of all and a long time before the "Court of Social Media" could cast a verdict.

A mickey of Black Velvet and two tickets to the Leaf game could turn an analyst around a lot faster than a 30-minute YouTube clip.

But then again, that was a kinder, gentler world we lived in. Sigh.

| Want to be the first to know about interesting Critical Metals, Gold and Base Metals investment ideas? Sign up to receive the FREE Streetwise Reports' newsletter. | Subscribe |

Important Disclosures:

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of [Cameco Corp., Western Uranium & Vanadium Corp., and American Eagle Gold Corp.].

- [Michael Ballanger]: I, or members of my immediate household or family, own securities of: [All]. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports' terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Michael Ballanger Disclosures

This letter makes no guarantee or warranty on the accuracy or completeness of the data provided. Nothing contained herein is intended or shall be deemed to be investment advice, implied or otherwise. This letter represents my views and replicates trades that I am making but nothing more than that. Always consult your registered advisor to assist you with your investments. I accept no liability for any loss arising from the use of the data contained on this letter. Options and junior mining stocks contain a high level of risk that may result in the loss of part or all invested capital and therefore are suitable for experienced and professional investors and traders only. One should be familiar with the risks involved in junior mining and options trading and we recommend consulting a financial adviser if you feel you do not understand the risks involved.